Once merely a figment of the imagination, flying cars now are nearly ready for takeoff.

A handful of designs already are undergoing testing, while a number of others are set to take to the air over the next few years. Concerns over technology and high costs could affect the flying car market, yet analysts appear to be optimistic about its success.

“Usually, the best indicator for how far away things are is when you start to see people testing them in real-life situations around the world,” says Jono Anderson, principal-strategy and innovation for consultancy KPMG.

However, observers agree much more development work is needed.

“The biggest challenge is the fact that one has to build the right vehicle, and the ones out there are not right yet,” says Mathias Entenmann, Berlin-based partner at consultant BCG Digital Ventures.

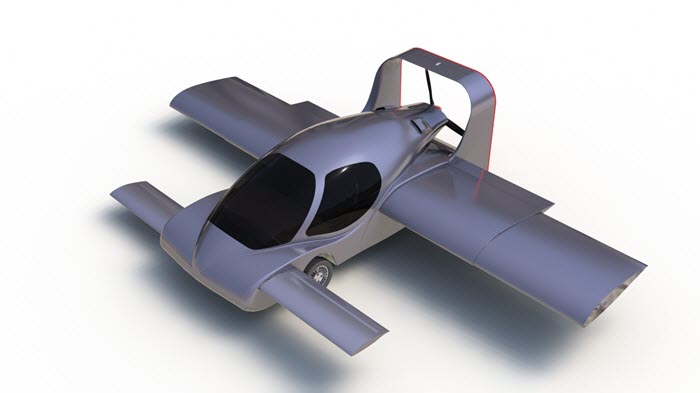

Different concepts have been tried over the years, but current designs are less about cars with wings and more about small vehicles that take off and land vertically, like helicopters but far quieter, for short commutes by air.

“The idea is to unlock the third dimension (vertical) to fly over traffic and reduce commute times,” says Graham Warwick, managing editor of technology at Aviation Week and Space Technology, like WardsAuto, a Penton Media publication. “This requires vertical takeoff and landing (VTOLs) so that air taxis can operate to and from vertiports or vertistops that are close to where commuters live or work.”

Warwick envisions these vertiports in city centers, city perimeters and at major airports that would serve as takeoff and landing spots for flying cars to deliver riders who are willing to pay a premium to dodge traffic in crowded urban centers. Commuters – business travelers are seen as the primary initial audience – would have to use more conventional means to get to a vertiport, meaning the more vertiports there are in a metropolitan area, the more convenient the service. Once there, flying cars quickly could transport passengers to another part of the city for an important business meeting or to the airport for a flight out of town.

U.S. developers account for the lion’s share of activity in the flying-car sector, although companies from France, the U.K., Germany, Japan, Russia, Slovakia and Israel are among those beginning to publicly show concepts.

Within the next five years, at least 10 companies are expected to launch flying cars on the market. Among those are PAL-V, Terrafugia, Aeromobil, Ehang, E-Volo, Urban Aeronautics, Kitty Hawk and Lilium Aviation, all of which have completed at least one test flight of their prototypes.

“Many pieces of the puzzle are coming together at the same time,” Anderson says. “We are able to see them being demonstrated around the world.”

Various developers have adopted different strategies to ensure their designs stand out in the increasingly crowded field, but all are focusing attention around the key issues of safety, noise and efficiency.

“There are programs and regulations under way, but nobody knows how quickly or easily they will be for vehicles (to meet),” Entenmann says.

Meanwhile, developers Aeromobil, PAL-V and Terrafugia already have begun accepting pre-orders for their flying cars.

Dutch manufacturer PAL-V expects to deliver its Liberty flying car by 2018 with costs beginning around $400,000 for its base model. Its Pioneer edition, priced at about $600,000, however, comes equipped with at-home training, power heating and fancy detailing.

The company offers a payment plan to cut the total upfront cost for customers. It is asking for a non-refundable deposit of $25,000 for the top-trim Pioneer, or $10,000 for the base Sport model. But if that is still too much, prospective buyers can place a refundable $2,500 deposit that will put them on a waiting list for now.

As for Aeromobil, pricing will begin at about $1.3 million for its flying car with expected delivery within three years. Aeromobil anticipates its target market to be wealthy supercar buyers, commuters working within a range of 125 miles (200 km) or so from their home, business people tired of wasting time waiting in line for check-in at airports and, most importantly, residents in countries with little or no infrastructure for planes.

Terrafugia’s Transition will be priced at about $279,000, with expected commercial arrival before 2025. The company’s target market includes current pilots and those who desire to become pilots.

Regulations Up in Air

Ultimately, flying cars, just like road vehicles, are expected to operate autonomously, which presents another technical hurdle for developers and further complicates the regulatory picture.

“I think at low-altitude capability and with the kinds of autonomous controls people are talking about, yes, there will be challenges getting the right regulations in place, but it should be achievable,” says Thomas Mayor, national partner-U.S. Aerospace and Industrial Markets Strategy for KPMG.

Initial plans call for services to launch with pilot-operated aircraft, while automation is running in the background to assist. As more experience is gained and public trust is built, flying cars will become fulltime autonomous vehicles, perhaps broadening the market potential to a critical mass of personal-use buyers, experts say.

Although interest is increasing and development is gaining ground, there are severe market challenges to widespread commercialization, including cost, strategies for takeoff and landing in urban areas, concerns over safety and human error, fuel efficiency, range and security.

“The market has real potential” if barriers can be overcome, James McMicking, chief strategy officer at British researcher Aerospace Technology Institute, tells The Wall Street Journal. “The manufacturers of these things can probably put them together relatively easily, but then to demonstrate they can work in the airspace above cities is really hard to do.”

Noise is another major issue to overcome. Warwick predicts that unless flying cars can improve significantly in that regard they won’t get off the ground. Air traffic control questions also must be solved.

“The hope is that existing FAA regulations can be adapted to enable these air taxis to be built,” Warwick says.

Safety concerns are likely to mean flying cars will need redundant power and control systems, but industry observers believe that’s a demand easily met.

“Multiple levels of redundancy in batteries, motors and flight controls are possible with electric aircraft that are not possible with conventional aircraft,” minimizing the chance of catastrophic failures, Warwick says.

That will be critical to consumer confidence and acceptance.

A recent survey by Michael Sivak and Brandon Schoettle at the University of Michigan Transportation Research Institute suggests it may be tough to get people into flying cars due to overall safety concerns and high costs.

Willingness to travel by flying car varies by age and gender, the study says, with men displaying greater positive feelings toward flying cars than women, and younger people appear more favorable to the concept than older people.

Overall, 64.8% of respondents express their desire to have access to flying cars; however, 62.8%, mostly women, say they are concerned primarily about safety, followed by congested airspace, performance in poor weather, performance at night and the complexity around learning to operate them.

Sanjay Dhall, founder and CEO of flying-car developer Detroit Flying Cars, says the real problem isn’t regulations and safety but the consumer experience.

“The way I see it, the real challenge is that it has to feel like a car,” says Dhall, who also heads engineering firm Emergent Systems, which is contributing to the flying-car project. “It doesn’t have to do with the regulations of what is street-legal or illegal. It’s about what it feels like and what people will feel comfortable in.”

For a car to be street-legal, it must be less than 8-ft. (2.4-m) wide, yet Dhall says flying-car companies have been paying far too much attention to this rule instead of focusing first on designing a flying car that will provide consumers with a satisfying experience.

“(Developers) are looking at it mostly from the regulatory standpoint and not from a people standpoint,” says Dhall, who is taking the opposite approach with his design.

Dhall’s invention — not airworthy yet, but expected to be fairly soon — is a sporty-looking craft with airplane wings that telescope into the body so it can operate as a car on ordinary roads. A prototype is in the works with an initial test flight planned for next summer.

“There is a great deal of interest on the subject, and there are many different kinds of approaches being taken,” Dhall says of the emerging flying-car field.

In the UMTRI study, 79.4% of respondents consider it extremely important or very important for flying cars to come equipped with a parachute, a demand developers already are addressing.

“Most of these designs incorporate a parachute that is deployed by rocket to bring the complete aircraft down safely,” Warwick says. “A true flying car (i.e. not a vertical-takeoff-and-landing air taxi) can glide like a conventional aircraft.”

Cost also will limit the market and could affect if and when flying cars get off the ground.

“We’ve done a lot of analysis where we’ve looked at different alternative modes of transportation and the trade-off between time and cost, and the time advantage is great,” Anderson says. “But, in the past it’s been incredibly expensive. People were not willing to pay their dollars for that time.”

Only 24.2% of respondents in the UMTRI study indicate a price range of $100,000 to $200,000 would be affordable, with men making up the majority of that group.

“As flying cars come about, they’re going to be a luxury product,” KPMG’s Mayor notes, adding market expansion will follow a trajectory similar to today’s other mobility services. “Early adoption by business executives and other trendsetters will start to open up a broader market. As the demand goes up, the costs become a little more affordable to acquire the flying car or flying urban-mobility device, and we will see a penetration similar to what we saw when Uber first launched.”

For both taxi-like and personally owned versions, respondents in the UMTRI poll generally prefer fully autonomous flying cars instead of a vehicle operated by a professional pilot, even though half of the respondents indicate they would be interested in attending training to obtain an appropriate driving license.

“I think regulators will be able to look at the technology and the safeguards around the flight-control systems and likely find a way, as Dubai is, to get comfortable doing and learning from pilots and getting those regulations in place to ensure we don’t have interference between these and normal commercial aircrafts,” Mayor says.

In regard to preferred energy source, about three-fifths of respondents to the UMTRI poll want their flying cars to be electric, a demand that seems to fit with the direction of most developers.

“Electric VTOLs promise to be cheaper, quieter and much safer,” Warwick says. “But to make the economics work, they have to be produced in high volumes at low prices – volumes much higher and prices much lower than the aircraft industry has ever achieved, and that are close to automotive volumes and price.”

With this in mind, ride-hailing services such as Airbus, Uber and the Intel’s Volocopter are brainstorming ideas around how to recharge batteries to ensure VTOLs can remain in service with the least amount of downtime.

Volocopter’s design allows for the battery to be swapped out in a few minutes. Uber is looking to integrate air and road travel into its app to make the choice easier for riders by showing them travel time and trip cost difference between the two modes. It also plans to implement a system closely related to Uber Pool, a cheaper way for air taxis to get to their destinations by matching them with others headed in the same direction.

“I think the initial usage will be a transportation company that operates them,” KPMG’s Anderson says. “The farther down the path we get, the closer we are to making it a reality.”