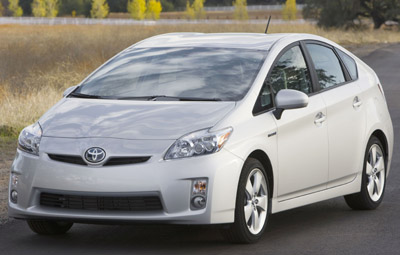

Could Toyota Motor Corp. become even more dominant than it already is in the midsize-car segment?

Yes, says its top U.S. official, who predicts the Prius hybrid-electric vehicle may soon usurp the Camry in annual sales.

“I think long-term, Prius as a nameplate could even outsell Camry as a nameplate, into this next decade,” Jim Lentz, president-Toyota Motor Sales U.S.A. Inc. tells Ward’s in a recent interview.

But Lentz doesn’t believe the Camry, the top-selling passenger-car in the U.S. for 11 of the last 12 years, will lose ground. “I think Prius will become just that much stronger,” he says, thanks to rising gas prices and greater eco awareness.

Still, the Prius has a long way to go to overtake Camry in the U.S.

Camry deliveries through October totaled 294,493 units vs. the Prius’ 118,290, Ward’s data shows.

Toyota typically sells more than 400,000 Camrys in the U.S. annually, although sales this year likely will fall short of that number. Toyota’s all-time Camry sales record stands at 473,108 units, set in 2007. The Prius’ all-time sales record is 181,221 units, also reached in 2007.

Lentz predicts Prius demand this year will reach roughly 140,000 units.

Toyota still is planning to build the Prius at its halted Blue Springs, MS, plant, but the start of production remains contingent on a global economic recovery and consumer demand for hybrids.

Contrary to reports, a range of Prius models is not official and “still my dream,” Lentz says, noting he makes a business case for the idea every time he ventures to Japan to meet with TMC’s top brass.

Company officials are fearful an expanded Prius line would cannibalize sales of Toyota’s other hybrids.

Still, Lentz says he is pleased that with just one model, the Prius remains a dominant force capable of warding off growing competition.

The Prius in the U.S. was released shortly after Honda Motor Co. Ltd.’s Insight HEV last spring. The Insight grew larger in its second generation and has a starting price below $20,000.

American Honda Motor Co. Inc. initially pegged Insight sales to reach about 100,000 units in North America in 2010, with some 80,000 to be sold in the U.S.

While the media made much of a potential duel between the two hybrids, the Insight has not put up much of a fight, with the Prius remaining the No.1 selling hybrid in the U.S. by a wide margin.

“Consumers buy on value and not necessarily price,” Lentz says of the Prius’ success in the marketplace this year.

He offers praise for the mild-hybrid Insight, as well as Honda’s decision to develop its own full hybrid system similar to Toyota’s. But Lentz says the packaging and technology the Prius offer proved more alluring to many consumers in 2009.

The Prius has an estimated fuel economy rating of 50 mpg (4.7 L/100 km) vs. the Insight’s 42 mpg (5.6 L/100 km). Both cars can seat five passengers, but the Prius is a D-segment model, larger than the C-segment Insight.

“While it may be more expensive than competitors’ (hybrids, consumers) still see more value in the (Prius),” Lentz says.