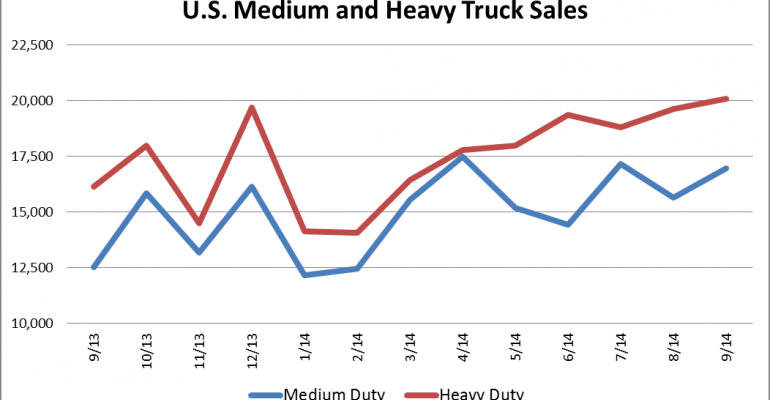

U.S. sales of medium- and heavy-duty trucks climbed 23.9% in September, the 13th month in a row big trucks have posted a year-over-year increase, WardsAuto data shows.

Volume totaled 37,054 units, up from 28,649 year-ago, and pushed year-to-date 2014 sales to 295,363 vehicles, 16.1% ahead of like-2013’s 254,388.

Class 8 sales rose 19.3% on volume of 20,078, the best September since 2006 and the first time the segment has topped 20,000 units since December, 2011. All manufacturers posted increases except for Kenworth (-2.0%). Peterbilt led all gainers, jumping 40.8% followed by Volvo, up 33.1% while segment leader Freightliner was up 27.0% and boosted its share to 36.0% from 33.8% a year earlier.

Through the first nine months, Class 8 sales totaled 158,288, up 19.4% from like-2013’s 132,593 and on pace to reach 210,000 units for full-year 2014, making it the best year for heavy trucks since the record set in 2006.

Medium-duty demand soared 29.9% in the month to 16,976 units, from 12,524 in September 2013 on the strength of double-digit gains in all weight classes.

Class 7 sales climbed 33.8% over year-ago on volume of 5,080, with all manufacturers posting gains except for Ford (-40.0%) and Peterbilt (-1.9%). The segment again was led by International, which for the second month in a row posted a triple-digit gain, up 123.4%. International’s share of Class 7 rose over 13 percentage points to 34.1%.

Class 6 deliveries were up 19.1% on unit volume of 4,109 vs. 3,306 year-ago. The group was led by Ford, up 37.8%. Class leader Freightliner posted the second best performance, up 28.5%, and raised its share to 39.3% from 36.4% a year earlier. Peterbilt fared the worst in the segment as deliveries plunged 16.9% on only 26 units. International and Hino also posted losses of 8.4% and 1.7%, respectively.

A triple-digit rise in sales of 609% posted by Freightliner on sales of 570 units against only 77 a year earlier lifted overall Class 5 deliveries 38.7% in September, the best performance of any segment. Freightliner's remarkable results along with a 42.9% increase by Isuzu, were enough to offset losses by Kenworth (-52.1%) and International (-25.1%).

Class 4 sales rose 11.2% to 1,161 units on mixed results. Isuzu domestic models improved 26.5% and its import models were up 19.5%, allowing Isuzu to seize 66% of the Class 4 market. Mitsubishi Fuso deliveries rose a modest 7.5% while Ford was down 10.6%.

Class 8 inventory increased by more than 6,500 units to 41,802, from 35,287 year-ago. Days’ supply was 50 in the current period, the same as in September 2013. Medium-duty truck makers ended September with 46,961 units in inventory, a 66-day supply. That compares with 40,844 and 75 days’ in like-2013.