For the second straight month bad weather put a damper on U.S. sales results, although February did rebound slightly from January.

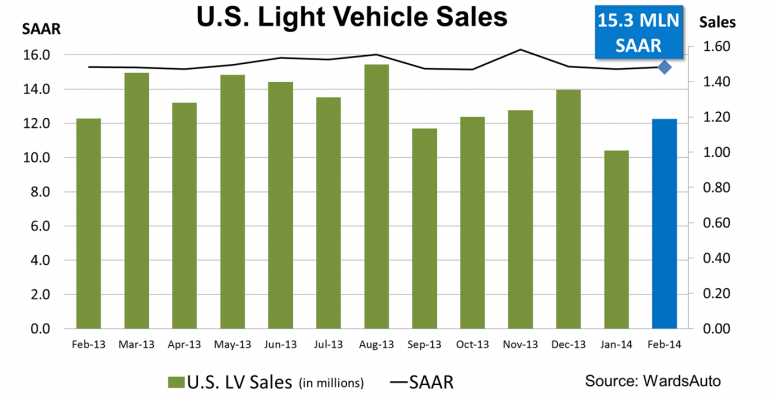

February’s light-vehicle sales equated to a 15.3 million seasonally adjusted annual rate, up slightly from January’s 9-month-low 15.2 million and spot-on with WardsAuto’s expectations for the month.

The combined January-February losses due to weather are hard to quantify specifically, but WardsAuto estimates the volume at 75,000 units, or roughly 3% of demand.

After declining in January for the first time since the summer of 2010, LV sales fell 0.1% from same-month 2013.

Sales totaled 1.19 million units for a daily selling rate of 49,523, compared with year-ago’s 49,566, with 24 selling days both periods.

There were some successes in the month centered on improved market shares from year-ago for CUVs and combined totals from all luxury segments.

CUVs, on the strength of small-size (including luxury versions), Middle and Large Luxury nameplates, posted a hefty 12.6% increase over year-ago, and their share of 27.9% was well above February 2013’s 24.8%.

All luxury-car segments increased volume and market share over year-ago except Luxury Lower, where the lowest-priced premium cars compete. The only other LV premium segments to record losses were Middle Luxury CUV and Large Luxury SUV.

Other segments with increases included Large Cars, Small Pickups and Large Vans.

Overall, car deliveries declined 6.0% from year-ago, thanks to a 5.4% drop in Small Cars and a whopping 12.3% shortfall in Middle Cars. All segments in the two aforementioned groups posted declines from year-ago.

After surging from 2010 through 2013, sales of Large Pickups dropped for the second straight month, albeit a small 0.2%. Share remained even with year-ago at 11.8%.

Of the high-volume companies, only Fiat-Chrysler and Nissan posted higher February volumes than year-ago. Daimler, Jaguar-Land Rover, Porsche, Subaru and Tesla also had gains.

Sales for market leader General Motors were down 1%, and Ford fell 6.4%.

Toyota’s deliveries dipped 4.3% from like-2013, and its share of 13.4% was its lowest for any month since October 2011. Honda’s sales dropped 7.0%, and its 8.4% penetration was its lowest for any month since August 2011.