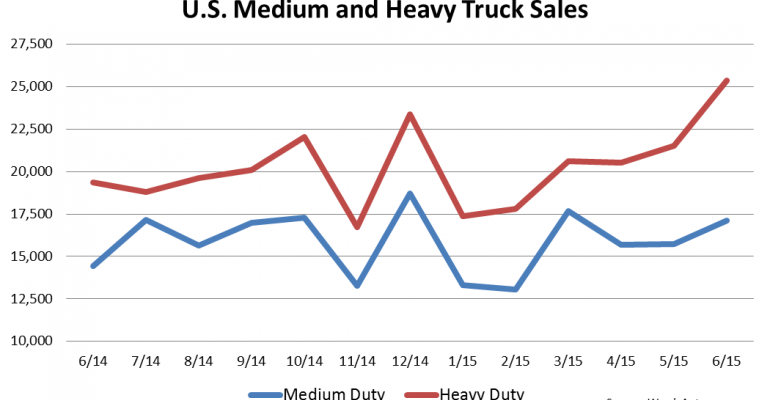

U.S. big-truck makers had the best June since 2006, and it was the 22nd month in a row of year-over-year sales increases. Medium- and heavy-duty truck sales rose 20.6% to 42,481 units, up from 33,308 prior-year, according to WardsAuto data.

Class 8 led all segments and set an all-time record for June which was also the third-best month on record. Sales jumped 25.7% on volume of 25,369 units vs. 19,373 year-ago as all companies enjoyed double-digit gains.

Daimler’s Western Star brand surged 79.9% and share leader Freightliner posted a 27.1% improvement, raising its market share to 37.0%. PACCAR’s Kenworth rose 27.3% and Peterbilt managed an 11.7% uptick.

Volvo posted a sales spike of 32.3% while stablemate Mack climbed 18.7%. International recovered from several months of mediocre performances and notched a 26.3% gain.

Through six months, Class 8 was up 23.4% on unit sales of 123,188 against 99,790 prior-year.

Overall medium-duty sales grew 13.8% vs. 2014 with 17,112 units delivered in June as all medium segments enjoyed gains.

Class 7 sales for the month were up 14.4% with only small volume sellers Hino and Kenworth reporting losses. Ford deliveries climbed 26.8%, leading all gainers in the segment. International was up 26.3% and share leader Freightliner edged up 12.1%. Hino dropped 22.9% and Kenworth stumbled slightly, down 2.8%.

Class 6 performed the best of any truck group with sales rising 29.2% to 4,936 units. Strong results by International (+108.0%) and Freightliner (+32.0%) were enough to offset smaller losses by Kenworth (-22.1%) and Hino (-7.9%).

A 7.6% gain recorded by class leader Ford and second-place FCA’s 27.2% upswing led Class 5 to an overall 5.4% improvement over June 2014. Freightliner suffered the largest decline, falling 36.6%, while Isuzu slipped 15.5%.

Class 4 sales were up a modest 1.5% to 1,475 units. A 20.4% gain in Isuzu domestic models were enough to offset a 35.7% loss posted by Ford.

The industry closed June with 52,536 Class 8 trucks in stock, equal to a 52-day supply. That compares with 46 days’ supply and 37,383 units year-ago.

Medium-duty inventories fell to a 78-day supply on 53,448 units, from 88 days’ and 53,177 units at the end of May. Year-ago, stocks stood at 49,180 Class 4-6 trucks, good for an 82-day supply.

In other big-truck news: FTR has released preliminary data showing June 2015 North American Class 8 truck net orders fell for the fourth straight month to 19,624 units, 25% below a year ago. Class 8 orders, while fairly predictable for the period, were somewhat above the current seasonal trend showing just a 2% month-over-month decline from May.