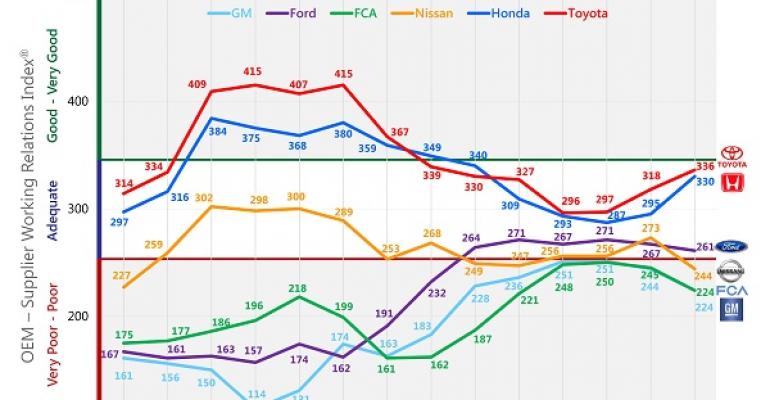

BIRMINGHAM, MI – Relations between the Detroit Three and their suppliers are worsening, according to the 15th Tier 1 OEM-Supplier Working Relations Index study.

The annual North American survey, helmed by Birmingham, MI-based consulting firm Planning Perspectives, found supplier trust of General Motors buyers is at its lowest in three years, and is the lowest of the main six OEMs surveyed, which include the Japanese Three.

Relations between Nissan buyers and their suppliers, after improving last year, also are worsening.

“I think the vice presidents (of purchasing at the Detroit Three and Nissan) certainly know where they’d like to go, and they’d like to do things better, because they know the benefits, particularly now that we have the economic model we can indicate what the actual cost is (of poor supplier relations),” John Henke, president-Planning Perspectives tells WardsAuto in an interview. “But they have not been able to get that desire manifested in the behaviors of (their) buyers who are dealing with the salespeople on a regular basis.”

Planning Perspectives last summer introduced an economic model revealing the impact of poor supplier relations and this year combines it with the WRI study. The firm finds if FCA U.S., Ford, GM and Nissan this year had achieved the same rise in the WRI ranking as Honda and Toyota, 8.7% on average, the four automakers collectively would have posted an estimated $2.02 billion higher operating income in 2014, with GM’s alone $750 million higher.

Toyota and Honda ranked first and second on this year’s survey, with WRI scores of 336 and 330, respectively, up from 318 and 295 in 2014.

Henke lauds Toyota and Honda for having good supplier relations, a result he says of their corporate cultures that don’t tolerate threats of lost business toward suppliers, behavior buyers for the Detroit Three engage in, and instead promote “respect for the individual” in all facets of business.

Also beneficial in creating non-adversarial relationships with their suppliers is Toyota and Honda’s thorough target costing. Both make clear from the beginning of negotiations with their suppliers what price they need to get for the parts they purchase. Honda and Toyota’s marketing arms, Henke says, do a good job determining the price of a future vehicle in the marketplace and what type of profitability they need to achieve.

The Detroit Three don’t do target costing, because “they cannot figure out exactly what the profit is on any vehicle they make,” Henke says. “They never could and they still can’t.

“It is the fault of engineering, because they’re not disciplined enough to do that,” Henke continues. “And it is the fault of finance because, in spite of how good they are, they’re not good enough to figure it out.”

While admitting target costing is a complex exercise for a company the size of General Motors, whose annual purchases rival those of the U.S. Department of Defense, he says if GM engaged in the practice 90% of the automaker’s supplier problems likely would disappear.

Nissan Least Desirable OEM to Work With

Nissan stands out on the lower rung of this year’s survey, scoring well below its fellow Japanese automakers with a WRI score of 244 this year, down from 273 last year.

Henke says Nissan is the “least Japanese of the Japanese (automakers),” citing as the culprit a large percentage of buyers that formerly worked for GM and Ford who brought their adversarial ways with them.

“Nissan is also coming under inordinate pressure to improve their profitability,” he adds. Nissan’s Power 88 business plan aims to increase the automaker’s corporate operating profit to a sustainable 8% by fiscal 2016.

In this year’s WRI, Nissan was the least desirable to work with among the main six OEMs surveyed, and the number of suppliers who say the threat of losing business if they didn’t comply with Nissan’s price-reduction requests rose from 17% last year to 29%.

Suppliers who sell to Nissan also say it has become more difficult to recover material-cost increases and to have contracts and commitments honored.

FCA and Ford dropped 21 and six points, respectively, from 2014, with Henke likening the latter, which plunged to its lowest ranking in five years, to “a log in a stream” for its steady, non-improving results.

He calls FCA “bad across the board” and cites invoice-management software from German software firm SAP as a key reason for poor supplier relations.

“(Last year we) found out that SAP was screwing up everything, and people weren’t getting paid when they should,” Henke says. “(FCA is) still the worst of the lot when it comes to paying invoices on time and resolving payment issues. This is the second full year this has been going on. That’s inexcusable. If those fundamental good business practices aren’t there, they don’t have even the base to build and do things.”

For this year’s WRI, Planning Perspectives received responses from 541 salespersons from 435 Tier 1 suppliers, representing 1,595 buying situations and 59% of the annual buy of the six OEMs. The firm received responses from employees of 44 of the top 50 North American suppliers and 67 of the top 100 North American suppliers.

The consulting firm for the fifth year in a row surveyed suppliers of BMW, Mercedes, and Volkswagen in North America for the WRI.

Mercedes-related responses were not calculated due to being incomplete or suspect, Henke says. He does provide BMW and VW scores, although not on the consolidated WRI graph due to the low amount of purchases both make with North American suppliers relative to the Detroit and Japanese Three.

BMW earned a WRI score of 346, up from 311 last year. That would lead Toyota in overall supplier relations if the German automaker were on the consolidated graph.

VW’s score, although up to 220 from 181 last year, places the automaker dead last in the 2015 WRI.