Canada’s light-vehicle output will be flat at best over the next six years due to a confluence of issues that have led North American auto makers to plan most new capacity in Mexico and invest in existing facilities in the U.S., a WardsAuto analysis finds.

As in the U.S., capacity cuts in Canada by the Detroit Three – General Motors, Ford and Chrysler – began years ago, driven by declining market share. But the production losses mostly were offset by other manufacturers, primarily Toyota and Honda.

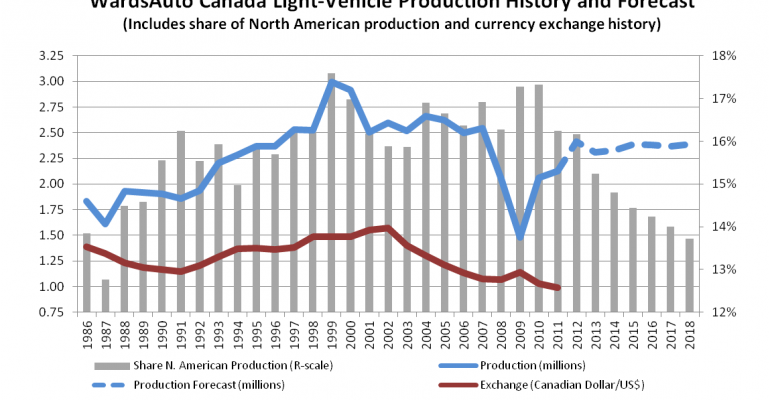

Since 1999, when Canadian LV output hit a record 3.0 million units, five assembly plants have closed, all belonging to Detroit Three auto makers. The only new factory to open was Toyota’s Woodstock, ON, facility in 2008. There have been other capacity increases, but they were accomplished through added shifts or facility improvements.

As recently as 2007, Canadian auto plants had capacity to build 3 million units annually on straight-time schedules. That number is down to 2.5 million this year and will fall slightly next year, when GM consolidates its remaining two factories into a single line at Oshawa 1.

A WardsAuto forecast for Canadian LV production shows relatively flat growth through 2018. However, the country’s share of North America’s total output will begin a gradual decline as Mexico’s rises and the U.S. remains steady.

Indeed, Mexico LV production is forecast to top 3 million units for the first time in 2014 and continue rising well after that. Capacity will climb, as well. By 2018, the country’s available straight-time output will equal 20% of the North American total, nearly double its 10.5% share of 2005.

U.S. volume also will continue to grow, although its North American share will be flat, averaging 66% annually.

Whether Canada can maintain stable volumes depends largely on a number of factors that are on converging paths.

GM Chairman and CEO Dan Akerson has been quoted as saying Canada is the most-expensive country in the world to manufacturer vehicles. One factor is that union labor in Canada has become more costly in Canada than in the U.S.

That’s because the United Auto Workers union took bigger concessions on worker compensation during the last contract negotiations, primarily due to the U.S. economic recession and the bankruptcies at GM and Chrysler.

Labor contracts with the Canadian Auto Workers union expire this year, and negotiations on new agreements likely will determine how the Detroit auto makers, which still account for more than half the production in the country, view their futures.

The degree to which the CAW is willing to give ground on pay and benefits vs. the commitment the Detroit Three are willing to make to maintain production could determine Canada’s automotive manufacturing footprint for years to come.

Another factor is the strengthened Canadian dollar, which has driven up the cost of vehicle exports, the majority of which go to the U.S.

Complicating matters is the flexibility enjoyed by some auto makers in Canada, both union and non-union companies, to move production elsewhere.

A number of vehicles built in Canada, especially those made by GM, Honda and Toyota, also are manufactured in the U.S., Mexico or Japan, or share architectures with products assembled elsewhere. If capacity can be freed up at plants in other countries, production can be shifted out of Canada with relative ease.

What’s more, major North American producers that don’t have operations in Canada, including Nissan, Volkswagen and Hyundai/Kia, are likely to expand their bases in Mexico and the southern U.S., regardless of exchange rates.

Investment elsewhere already is happening. Honda, Mazda, Nissan and VW all are opening new factories in Mexico; Nissan in 2013, Honda and Mazda in 2014 and VW in 2016.

In the U.S. later this year, VW will add a third shift at its Tennessee plant, Daimler and Hyundai will bump up capacity at factories in Alabama and Nissan will bring additional product to its facility in Mississippi. Next year, Honda will boost capacity in Alabama, and BMW will do the same at its South Carolina operation in 2014.

The Detroit Three also are raising capacity. By the end of this year, Ford will have added third assembly crews at three U.S. plants, and Chrysler will do so at two facilities.

GM reopens its Spring Hill, TN, assembly line later this year to build the Chevrolet Equinox, also produced in Canada, and recently announced a third shift for its Arlington, TX, fullsize-SUV factory for 2013.

One constant the Canadian auto industry can depend on is solid production levels at Honda and Toyota. Together, the two Japanese manufacturers have 875,000 units of annual straight-time capacity, accounting for close to 40% of Canada’s LV production.

Both auto makers need all the capacity they can muster to meet demand in North America. The two are emphasizing local sourcing of vehicles because the record-high strength of the yen is making exports from Japan costly.

That said, should unforeseen market troubles lead to excess capacity in their U.S. and Mexico operations, Honda and Toyota easily could shift a large portion of their Canada output to those plants.