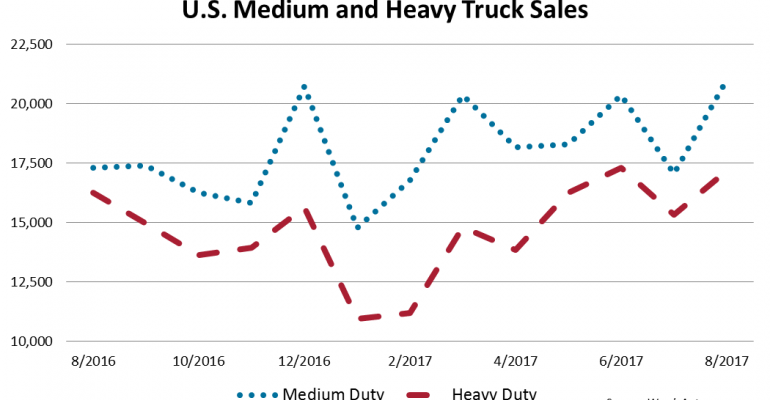

Medium- and heavy-duty truck sales continue to soar in the U.S. with another month of year-over-year growth in August. For the third month in a row, Classes 4-8 sales rose 9.6%, delivering 38,176 trucks compared to 2016’s 33,556. This gain hasn’t allowed the year-to-date volume to catch up, still 3.3% behind 2016 with 263,625 units.

After the first year-over-year growth for Class 8 in July, August deliveries outsold again, up 1.6% to 17,166 units compared to last year’s 16,262. Daimler’s Western Star grew 18.0% but Freightliner’s 8.1% drop on high-volume brought Daimler to an overall dip of 6.5% in sales. International saw the best improvement in the segment, rising 34.7% to 2,751 units. Kenworth (-7.1%) and Peterbilt (+17.6%) balanced out, leaving PACCAR with a 4.6% growth in sales. Volvo Truck came 7.0% under like-2016 from mixed results from Mack (+2.3%) and Volvo (-14.1%).

Even though U.S. heavy-truck sales have had two good months in a row, year-to-date sales still crawled 13.2% behind prior year with 116,814 units.

Medium-duty truck sales, however, continue to be ahead of 2016, up 6.3% at 146,811 units year-to-date. August helped widen the gap even more with a 17.0% jump to 21,010 deliveries from prior-year’s 17,294.

Class 7 sales inched up 3.7% to 7,003 deliveries last month, due largely to International’s 18.3% gain on high volume (2,870 units). Volume leader Freightliner dropped 4.5% on 2,900 deliveries.

Sales in Class 6 grew 16.1% to 5,449 units. Large gains were seen from each truck maker in the group, starting with International’s largest gain of 37.9%. Ford (+5.7%) and Freightliner (+10.2%) continue to grow and accounted for 61.9% of the group’s market share in August.

Both domestics (+28.2%) and imports (+14.7%) grew substantially, resulting in Class 5 sales to climb 26.5% for the month. Taking up 68.6% market share, Ford soared to 4,647 units, a 41.8% jump from 2016’s 3,155. Runner-up FCA dipped 4.9% to 1,241 units compared to year-ago’s 1,257. Isuzu’s import line dropped 16.3%, while Hino spiked 118.4%.

With the largest growth again in August, Class 4 truck sales grew 54.0% to 1,783 units. Since May, Class 4 sales have seen double-digit year-over-year gains, resulting in a 28.1% gap in year-to-date sales with 11,910 deliveries compared to last year’s 9,296. Isuzu led the group with large gains from its domestic (+30.1%) and import (+23.5%) lines, consuming 64.6% market share. Daimler soared with a 670.4% gain. Hino was the only truck maker to post a drop in sales, down 10.0% to 57 deliveries.

The industry closed August with 39,349 Class 8 trucks in stock, equal to a 62-day supply. That compares with 69 days’ supply and 43,107 units year-ago.

Medium-duty inventories swelled to an 81-day supply on 63,070 units from 84 days’ and 55,645 units at the end of August 2016.